Forex (FX) is an acronym for Foreign Exchange and hence Forex trading refers to trading of currencies from different countries against each other. With over USD 2000 billion trading per day, Forex is the biggest market in the world, dwarfing the stock market and the best thing is, it is open 24 hours a day!

So how does one earn money in Forex? A Forex trader generates profits by speculating whether a currency will rise or fall against the other. You begin by choosing a currency pair that you expect to change in value and placing your order. For example, you spent USD 1,600 to purchase £1,000 today. Few months later, if the value of sterling pounds versus USD increases, say £1,000 to USD 2000, you would gain USD 400 when you chose to end the trade. Alternatively, one can also hold his currency pair for minutes or days, depending on his own strategy. It is commonly thought that the best money-making opportunities are with the most commonly traded currencies, namely the US Dollar, Euro, British Pound, Swiss Franc, Japanese Yen, Canadian Dollar and Australian Dollar, collectively known as the "Majors".

Although historically only available to large financial institutions and companies, Forex is now accessible by members of public due to the prevalence of the internet and therefore, is a good opportunity for investors to grow their money. Contrary to common notion, you do not need a lot of money to start trading Forex. Some people even start with as little as USD 200.

While there are people who make a living by relying solely on Forex trading, it is important to be realistic with your expectations, especially if you are a beginner. As easy as it sounds, learning the correct strategies and practising with paper trading before using real money can save you from losing your hard-earned money. After all, no investments come without risks and it is how you manage the risk involved that makes the difference.

Forex Beginner: How to Open a Forex Account

Unlike the stock market, Forex trading does not happen at a physical location nor does it have a central exchange. Hence, a Forex trader can trade wherever they are, 24 hours a day for 5.5 days a week! No wonder that Forex trading is so attractive to many new investors.

To start Forex trading, you would first need to open an online trading account where all your currency transactions will take place. Opening a Forex account involves three simple steps:

Choose an appropriate Forex trading site

There are two things to consider when choosing the right Forex trading site for you. First is the leverage the site offers. Each site offers different leverage, which can range from 50:1 to as high as 250:1. A leverage factor of 50:1 for instance, would allow a person with USD 1,000 in his account to trade USD 50,000 in the Forex market. While this could allow you to make large gains with small investments, it can also amplify your losses if a trade moves against you. It is important to understand the risks involved in determining your intended leverage. Also, the trading site should be commission-free, as you do not need to go through a third party, like brokers for stocks. Examine the site properly before you decide to make sure they offer features that you need.

Choose an suitable account type

Forex trading accounts come in different sizes, ranging from USD 25 (micro / mini accounts) to USD 10,000 (standard accounts). Choose the account size according to the amount you want to invest in. Choose Forex trading spot account, which allows instantaneous trades and is more popular, instead of a futures account.

Register for a Forex trading account

Most of the registration is done online and would require your personal details as well as your credit card details for real cash trades. Make sure you enter your email address properly.

Activate your Forex trading account

You would be asked to verify your details through several steps. Make sure you read through and understand the terms and conditions before you sign them online. Pay particular attention to the operating hours of the site, the availability of live technical support and any hidden commission / charges. Some sites also offer a limited-time demo account with no real cash involved. You can use it to familiarise yourself with Forex trading before you trade with real cash.

Congratulations! You are now ready to hit the Forex market!

Understanding Forex Jargon

One of the major frustrations of Forex traders is the awful use of jargon. Googling these terms does not seem to help either because the explanations are more often than not, contain more jargon. Here are five common technical terms used in Forex trading explained in layman terms:

Quote: Forex trading is always done in pairs and thus a currency is always quoted relative to another currency, e.g. USD/JPY, EUR/USD, AUD/GBP. A quote would look like this: USD/JPY = 100.00. The currency on the left (in this case, US dollar) is known as the "base currency" and always equal to 1 unit, whereas the currency on the right (in this case, Japanese Yen) is called the quote or counter currency. A quote is how much worth one unit of the base currency, hence this particular quote means that USD 1 can purchase 100.00 Japanses Yen.

Pip: stands for "percentage in point" which is the smallest increment of trade in Forex. Prices in Forex market are always quoted to the fourth decimal place, except Japanese Yen; e.g. when EUR/USD rises from 1.5200 to 1.5201, it rises by 1 pip. For Japanese Yen, 1 pip is equivalent to 0.01 (two decimal places). Most currency pairs trade between 100 - 150 pips daily.

Bid / Ask: In Forex, to bid means "to buy" whereas "to ask" means "to sell". The quote on the left is the bid (buy) price while the quote on the right is the ask (sell) price, and bidding price is always lower than the asking price. The base currency would be the one in which the transaction would be conducted.

Let's look at the example, EUR/USD 1.2600/02. To sell this currency pair means to sell the base currency, i.e. the EURO. The market would buy your 1 EURO base currency with 1.2600 USD. On the other hand, to buy 1 EURO, you need 1.2602 Japanese Yen.

Spread: is the difference between the ask price and the bid price. Using the same example as above, the spread was 2 pips, which you automatically pay to your broker at every trade.

Margin: The minimum amount of money required to place a trade with a broker. You can trade as long as your account has this minimum amount, otherwise your accounts would be closed down.

There's more to this series. Continue reading…

Next: Five Golden Rules of Forex Trading

Tags: Forex

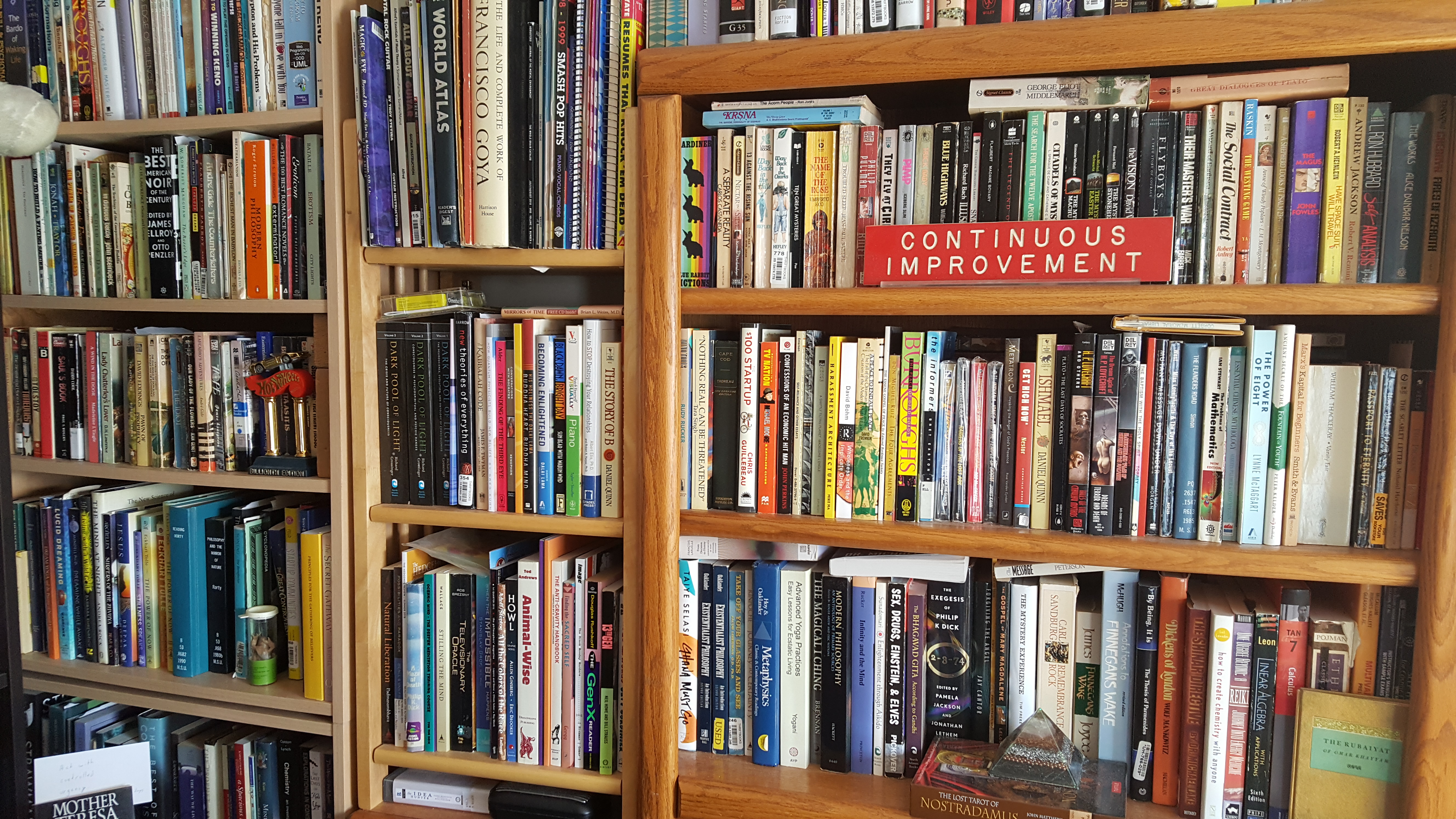

The Top 10 Books of All Time

The Top 10 Books of All Time

I have read thousands of books over the course of my life and I want to share with you what I consider to be the top 10 books of all time....

These are the blogs I follow:

No particular order. These are not ranked.

- VOX POPOLI

- Western Rifle Shooters Association

- Daily Pundit

- Free North Carolina

- Big Country Expat

- The Burning Platform

- According to Hoyt

- Raconteur Report

- Liberty Nation

- American Partisan

- The Z Man

- NC Renegades

- Bayou Renaissance Man

- The Tactical Hermit

- American Thinker

- PCR

- American Greatness

- James Howard Kunstler

- Antidem

- Dissident American

- Normal American

- Liberty's Torch

- Daily Stormer

- Cutting Thru the Mtx

- Larwyn’s Linx

These are the websites I visit as I "wander about Athens with a lamp":

- Cutting Edge Ministries

- Lion's Roar - Nichiren

- Pantheon - Article about it, here.

- Dilbert, he's usually good for a larf

- News to Keep You Out of the Camps

- Training Manuals

- Politically Incorrect Humor

- Libtards News

- The Cutting Edge - ministry

- Amerika dot org

- Censored Today

- Dissent Watch

- Counter Currents

- Liberty Nation

- Liberty Nation Gen Z

- Bongino's site

Wikipedia, no...Conservapedia, yes- Memeorandum dot com

- Deplatdformed Space

- Now the End Begins

- Christmas is a Lie

- Metallicman NEW

- jimstone.is NEW

Where can you find me on social media?

- https://gab.com/tom_k

- https://www.minds.com/tomk77

- https://twitter.com/TomKuptz

- https://steemit.com/@earningsanywhere

- https://www.amazon.com/gp/profile/amzn1.account.AG5BUAS7K3TAWJPXGRGZ3ZZIYKBQ

- https://www.reddit.com/user/peacelovedotme

- https://foodgame.surf/myprofile.php?uid=2486 NEW!

- https://locals.com/member/tomkuptz

How about video/music networks?

- https://www.youtube.com/channel/UCikXust__smv-nzB801K31A

- https://www.bitchute.com/channel/SaPbszSASXR5/

- https://rumble.com/register/peacelovedotme/

- https://trovo.live/peacelove-dot-me

- https://odysee.com/$/invite/JDazqsEGAeM8N88mKNBkLzSRHPYMtNrx

Stop Satanism • Blaspheme Never Again !

Stop Satanism • Blaspheme Never Again !

The First Amendment protects against the infringement of religion and in so doing, it protects religion itself from blasphemers, heretics, iconoclasts, and apostates.

Satanism is NOT a legitimate religion and does not deserve any protections under the First Amendment.

Satanism exists solely as a repudiation of another religion, Christianity. Satan is NOT a god. He's a flunky. Any worship of Satan is merely a rude gesture AGAINST the God of Christianity. The entire act of worship in Satanism IS flinging an insult at the God of Christianity. As such, it is not the practice of a religion, but rather the practice of an insult.

NEW SERIES

Neurolinguistic Programming

You may already know that NLP stands for Neuro-Linguistic Programming. The name is derived from three components that most affect our human experience: our neurology, our language, and our programming, or the way in which we have learned to model the world around us. The development of NLP began in the 1970s in California, by Richard Bandler and John Grinder as an innovative approach to psychotherapy, communication, and personal development.

NLP studies the methods, validity and scope involved in what it means to be human on many different levels and dimensions. It focuses on fostering competence and flexibility of behavior, and involves analytical and strategic thought to understand what mental processes are behind human behavior.